Last year I searched for the Top 5 financial institutions in total return to shareholders because I grew weary of the "get big or get out" mentality of many bankers and industry pundits. If their platitudes about scale and all that goes with it are correct, then the largest FIs should logically demonstrate better shareholder returns.

Not so last year, and not so again this year.

My method was to search for the best banks based on total return to shareholders over the past five years... capital appreciation and dividends. However, to exclude trading inefficiencies associated with illiquidity, I filtered for those FIs that trade over 2,000 shares per day. This, naturally, eliminated many of the smaller, illiquid FIs.

For comparison purposes, here are last year's top five, as measured during September, 2011:

This year's list is in the table below:

The two report A-listers are BofI Holdings, Inc., and Bank of the Ozarks, Inc. Special mentions are Signature Bank that was #7 this year, and German American Bancorp that was #9. No slouches there.

BofI Holdings Inc. and its subsidiary BofI Federal Bank aspire to be the most innovative branchless bank in the United States providing products and services superior to their competitors, branch-based or otherwise. In its latest investor presentation, BofI highlighted it's expense ratio (operating expense as a percent of average assets) compared to peer as 1.67% versus 3.17%, respectively, and efficiency ratio (operating expense as a percent of total revenue) compared to peer as 35% versus 63%, respectively. So, as a branchless bank, BofI has leveraged its significantly lower operating expenses into profit. That profit led to the top spot in five year total return to shareholders, two years running. Well done!

In 1979, George Gleason, a 25-year-old attorney, purchased controlling interest and assumed active management of the bank as Chairman of the Board and Chief Executive Officer. At the time, the bank had a couple dozen employees and total assets of $28 million. Today the bank has more than 100 offices in seven states. It's growth since 2010 has been fueled by seven purchases of failed banks. This has led to $863 million of covered loans (loss share arrangements with FDIC), and a yield on such loans of 8.69%, according to its latest investor presentation. This has led to a mind blowing net interest margin of 6.01% for the quarter ended September 30, 2012. OZRK moved up three places in total return to shareholders from last year's ranking. Well done!

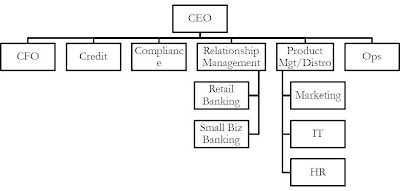

New to the august list is Access National, whose mission is to provide credit, treasury management and private banking services to emerging businesses with revenues of up to $100 million... very specific, and refreshing given that so many banks cannot choose a specific niche for fear of alienating other constituencies. Those buckshot banks don't have much representation in this top 5 list. Coincidence? You decide. Another interesting fact is that Access National's management team, which owns 15% of the bank, is relatively young, ranging in age between 41 and 53 years old. To be fair, Access National is headquartered in Reston, VA, one of the best banking markets in the country. Focused mission, young management team, great markets... great ingredients in a success recipe.

Founded in 1834, Hingham Savings' mission is to provide the finest in community banking, with integrity and teamwork. This usually earns the jfb blah, blah, blah statement since we can affix that mission to 90% of the banks across the US. But slow and steady wins the race, in this case. Hingham's ROA from 2007-2011 was 0.63%, 0.81%, 0.93%, 1.05%, and 1.14% respectively. It's third quarter 2012 ROA was 1.15%. Slow, steady improvement. By the way, 0.63% represented it's lowest ROA in a 10-year stretch. But looking at their performance, it's fair to ask... "what financial crisis?" Hingham's tagline, "Simple Banking. Honest Value. Happy Customers" is consistent with a typical industry theme described by one of my colleagues: "boring banking is beautiful". It's this simplicity and consistent performance that most likely resulted in their superior, long-term total return to their shareholders.

Texas Capital Bank delivers highly personalized financial services to Texas-based businesses with more than $5 million in annual revenue. Recognizing the inherent link between business owners and their personal wealth, TCB manages the personal wealth of Texans with net worth of more than $1 million. Similar to three of the five banks on our list, TCB is a relatively recent addition to banking, being founded in 1998. Actually, since Bank of the Ozarks has significantly changed since it's FDIC acquisition spree, one might include them in the list of "new" banks. TCB is largely a growth story, and mostly organic growth since it has not been very acquisitive. Since 2007, operating revenue has grown at a 22% compound annual growth rate (CAGR), while non-interest expenses grew at a 17% CAGR. This positive operating leverage generated net income CAGR of 32% during the same period, supporting their Top 5 position in total return to shareholders. Well done TCB!

There you have it! The jfb all stars in top 5 total return. Congratulations to all of the above that developed a specific strategy and is clearly executing well. Your shareholders have been rewarded!

Do you think there are themes that have led to these banks' performance?

~ Jeff

Note: I make no investment recommendations in my blog. Please do not claim to invest in any security based on what you read here. You should make your own decisions in that regard. FINRA makes people take a test to ensure they know what they are doing before recommending securities. I'm sure that strategy works out.