I recently taught Bank Profitability to a Washington Bankers' school. As part of the curriculum, we discussed the cost structure of financial institutions and how it impacts decision making.

True to the subject, we discussed using product profitability data to make decisions. For example, if a product is unprofitable, should we make changes to it or cut our losses? The answer is not so easy, in my opinion.

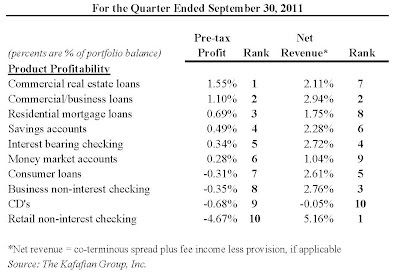

In reviewing the table below, one might conclude that we need to do something about business checking. How can such a core offering be ranked eight of ten in profitability? But, as with everything, there are reasons.

One is how profitability is measured. The method from the table is using funds transfer pricing to determine the spread generated from the product. In such a low interest rate environment, the funding credit is at historic lows. Aside from the interest rate environment, the product's profitability is determined by fully absorbed costing. This begs the question about the variability, or lack thereof, of operating costs.

Community financial institutions don't have much in terms of variable costs. Let's ask the question, what cost would be reduced by discontinuing this product? The answer... very little. Perhaps the core processor charges per account, and the business is on bill pay, also invoiced per account. But will we reduce branches without the product? Probably not and branches represent a significant cost to deposit products.

This is why leveraging your FIs infrastructure is so important to profitability. We have a step variable cost structure. That means we buy resources in bulk. Similar to buying a palate of Hot Pockets at Sam's Club, we add resources and then utilize the resources over time until they are exhausted. If properly utilized, the FIs operating cost ratios should decline over time, until the infrastructure becomes stressed.

How do you tell when your infrastructure is stressed? One CEO uses the parking lot theory. He looks out in the parking lot to see how many cars remain at the Bank after 6pm. I'm sure there are other, more sophisticated methods, but the overall point is that there is a consistent, downward trend in operating cost per account.

In terms of strategic decision making, understanding the FIs cost structure may motivate the FI to increase volumes in business checking, knowing that the marginal cost to add more accounts is minimal, and the revenue per account is significant (3rd greatest in the above menu). Not to mention that the average balance per account tends to be greater than most others. Discontinuing a product based on its fully absorbed profitability simply pushes the costs currently borne by the doomed product to other products.

How do you use your profitability information?

~ Jeff

No comments:

Post a Comment